With Monday's news on GM, the sacking of their CEO and all the talk about getting their cost structure down to globally competitive levels, renegotiating their bloated union contracts and having the company reemerge from bankruptcy as a leaner and meaner competitor, what businessman comes to mind, a businessman who flat out called this scenario four months ago?

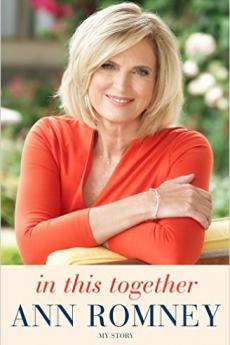

Mitt Romney.

Wall Street Journal:

By PAUL INGRASSIA

What's good for General Motors really is good for America after all. And vice versa.Mr. Ingrassia is a former Dow Jones executive and Detroit bureau chief for this newspaper. "Crash Course," his book on the auto industry's current crisis, will be published by Random House next January.

That's the best way to read the sad but necessary -- in fact, long overdue -- departure of General Motors CEO Rick Wagoner Sunday, at the behest of President Barack Obama's Automotive Task Force. Give the Obama team credit, too, for replacing most of GM's pet-rock board of directors, which put loyalty to Mr. Wagoner above duty to shareholders while the company imploded.

These steps add serious credibility to the task force's effort to force fundamental changes at GM and Chrysler, the two car companies getting federal aid. Chrysler was given 30 days to form an alliance with another car company, most likely Fiat. The task force concluded, correctly, that Chrysler can't survive as an independent company. GM has 60 days to offer a realistic survival plan with new concessions from bondholders and the United Auto Workers union.

Sound familiar? That's basically what the Bush administration told GM last December, before the Bushies bypassed Congress and doled out the first $13 billion. By extending the deadline yesterday, the task force risked coming across like a hapless parent saying to the misbehaving children, "Kids, this time I really mean it." But dumping the board and Mr. Wagoner -- just two weeks after the executive insisted his job was secure -- changes the game, as does the president's blunt talk yesterday. Mr. Obama raised the possibility of "using our bankruptcy code to help them restructure and emerge stronger."

I'll have to confess initial skepticism about the president's Automotive Task Force, but so far I'm impressed. Business executives are supposed to be hard-nosed realists, but we heard more realism from Mr. Obama yesterday than we've heard from Detroit in years.

Speaking of unreality, Michigan Gov. Jennifer Granholm said that Mr. Wagoner is a "sacrificial lamb," but that's only if you don't look at his record. Since Mr. Wagoner became CEO in June 2000, GM's stock price has declined from more than $70 a share to under $3. The past year has been brutal on all stocks, but even in 2005, when car sales stood at near-record levels, the company lost $10.6 billion and the stock had plunged nearly 75% from when Mr. Wagoner took the helm. GM also suffered a steady slide in its U.S. market share -- from 28% to 22% -- during the Wagoner era.

In 2001, Mr. Wagoner negotiated a European alliance with Fiat (yep, the same company now talking to Chrysler) on terms that could have forced GM to buy the Italian auto maker when Fiat was hemorrhaging money. GM had to pay $2 billion to buy its way out of that dilemma. Then Mr. Wagoner belatedly placed big bets on full-sized SUVs and pickup trucks just as gas prices started to soar and gas-electric hybrids got popular. GM's answer is the Chevy Volt, a more-advanced hybrid that's still two years from launch and will cost around $35,000 when it does appear. The sad irony here is that Mr. Wagoner's path to prominence at GM began the last time a General Motors CEO was ousted -- though that time by the company's board instead of by the president of the United States. After the departure of Robert Stempel in November 1992, Mr. Wagoner was named GM's chief financial officer at age 39. He was the youngest member of a new executive team installed to fix the ailing company.

As GM recovered in the 1990s thanks to some good management decisions and a good economy, Mr. Wagoner continued his advance. He ran the company's North American operations and then became president and chief operating officer before becoming CEO at age 48. But along the way, a couple of crises seemed to dim Mr.

Wagoner's ardor for reform.

One occurred in 1998, when GM took on the UAW at a metal-stamping plant in Flint, Mich., where workers had negotiated production quotas that they could fill with just five hours of work, though they were getting paid for a full eight hours. When GM responded by moving some of the metal-stamping machinery elsewhere, workers went on strike, shutting down dozens of other GM factories that depended on the parts made in Flint. When the strike ended 54 days later GM had lost $2.2 billion, as well as any determination to insist on work-rules changes from the union.

Then in December 2000, Mr. Wagoner's first major move as CEO was to announce the closing of Oldsmobile, which had shrunk to a fraction of its former sales. But the up-front announcement -- as opposed to a quiet buyout effort -- enabled dealers to demand top dollar for closing their franchise. It took GM nearly four years, myriad lawsuits and more than $1 billion to shut Oldsmobile down.

After those two episodes, say former General Motors executives, any discussion of further culling GM's lineup of eight different brands or of demanding major improvements in factory productivity became strictly off-limits with Mr. Wagoner. There was a "can't do" mentality that accepted too many brands, too many dealers and too many workers as immutable facts of life that could only be changed slowly and gingerly, if ever. That might have worked had Americans continued buying big pickups and SUVs at a record-setting pace for another decade or two. But that prospect never was realistic, even before car sales collapsed nine months ago. Mr. Wagoner stuck with overly rosy forecasts until the very end.

The good news for him is that he's now free to work for more than $1 a year -- the salary he reluctantly accepted as a condition of GM's first dollop of government dollars. Meanwhile, the two key questions for General Motors are who should lead the company and whether it really can successfully restructure without filing for bankruptcy.

On the first question, I'd vote for an outsider. Fritz Henderson, the company's president and GM lifer who's replacing Mr. Wagoner, might be very capable, but the plain fact is that GM is far too inbred. Over the years the company has launched successful innovations ranging from a joint-venture plant with Toyota in California to the Saturn subsidiary to modular auto-assembly techniques in Brazil, but has failed to capitalize on any of them.

Larry Kellner of Continental Airlines is one outside candidate worth considering. I've never met him, but he runs a terrific airline whose unionized employees really understand customer service. Lewis Campbell of Textron is another. He is (full disclosure) a personal friend. But he spent his formative years at GM, and thus knows something about the auto industry, before leaving nearly two decades ago.

As for bankruptcy, President Obama and task force chief Steve Rattner clearly would rather avoid that, for both GM and Chrysler. Politically, it's a savvy move for them to give the companies one more chance to avoid bankruptcy. The president's words yesterday will make it hard for him to back down.

GM now needs concessions from the bondholders (who have $27 billion in unsecured debt) and the UAW. Basically, both parties will have to take GM stock in lieu of much of the cash they're owed. In the end, however, it's more likely that the union and the bondholders will find it easier to accept changes that are forced on them instead of suggested to them. That probably will mean bankruptcy, or something like it, before this saga ends.

No comments:

Post a Comment